In most of the Contracts , based on C.P.W.D. Contract Form or its variants , there is provision of ‘Incentive for early completion’ or ‘Bonus’ (Sub-Clause 2-A) as well as ‘Escalation’ (Sub-Clauses 10-C , 10-CA & 10-CC) . There is also provision for Deviations

, their Pricing and Extra Time on account of Deviations under Clause 12 and its Sub- Clauses 12.1 through 12.6 .

Though there is clarity on these two matters in case a work including its deviations is completed within the Stipulate Period of Completion (SPC) , there is no such clarity when the work is deviated beyond the contract amount and completed after the SPC . This Article discusses the complications and possibilities relating to these two matters in such works which get deviated beyond the contract amount and completed after the SPC

.

For our analysis , let us take a sample work with the following data :

Agreement Amount – Rs.20,00,00,000/-

Stipulated Period for Completion – 12 Months

{Note : Normally for Stipulated Period for Completion less than or equal to the period mentioned in Schedule ‘F’ of GCC , Escalation under Clause 10 CC is not applicable and Clauses 10 C (labour) & 10 CA (material) are made applicable , which together fall short of the benefit available under Clause 10 CC }

Extra amount of work executed – Rs.5,00,00,000/- (without Escalation)

Actual Period of Completion – 18 Months

Period of Hindrances , attributable entirely to the Department – 5 months (EOT granted , without levy of compensation under Clause 2)

Escalation under Clause 10 CC (if this Clause becomes applicable) – Rs.1,00,00,000/-

1.Payment of Bonus :

Clause 2-A of the General Conditions of Contract (GCC) , relating to payment of Bonus

, is made applicable to most of the works , as an incentive for their early completion , and runs as under :

“In case , the contractor completes the work ahead of scheduled completion time , a Bonus @ 1% (one percent) of the tendered value per month , computed on per day basis , shall be payable to the contractor , subject to a maximum limit of 5% (five percent) of the tendered value . The amount of bonus , if payable , shall be paid along with the final bill after completion of work . Provided always that provision of Clause 2 A shall be applicable only when so provided in ‘Schedule F’.”

As per the above Clause a contractor becomes entitled to Bonus if he completes the work ahead of scheduled completion time .

The scheduled completion time has , however , not been specifically defined in the agreement . The only time period mentioned in the agreement is the ‘Time allowed for the execution of work’ in schedule ‘F’ . In our case it is 12 months . Therefore , there can be no doubt that the scheduled completion time for the work has been prescribed as 12 months . Further , a reading of Clause 12.1 of the agreement (GCC) , that is reproduced after the next four paras , leaves no doubt that the scheduled completion time is nothing but the time of completion prescribed in the agreement which shall be extended in the event of any deviation resulting in additional cost over the tendered value sum being ordered plus such further additional time as may be considered necessary by the Engineer-in-Charge .

Something can be extended only when it is already present . Some non-existent thing can not be extended ! A time period of 12 months exists in the agreement and any reference to extension of time can only be a reference to this time period . The Clause 12.1 (ii) further says “such further additional time as may be considered necessary by the Engineer-in-Charge” . This further additional time is nothing but the time that gets wasted due to various delays and hindrances on the part of the Department that occur during the progress of the work on which the Contractor has no control and which the Engineer-in-Charge (E-in-C) grants under the EOT , without levy of compensation .

There is a specific provision for Extension of Time under Clause 5 of the agreement on account of various delays and hindrances . When the scheduled time for completion of work

, as given in schedule ‘F’ , gets extended under Clauses 5 & 12.1 the provisions that are based on this time period of 12 months shall disappear and shall become inapplicable .

In their place the other conditions relevant to the changed time period shall automatically become applicable . The changed time period resulting from additional work and various hindrances and delays becomes the scheduled completion time to which both Bonus and Escalation have got to be related to .

It is also to be noted that Clause 10 CC , relating to payment of Escalation in Prices , mentions that “ such compensation for escalation in prices and wages shall be available only for the work done during the Stipulated Period of the contract including the justified period extended under the provisions of Clause 5 of the contract without any action under Clause 2 ”.

This means that the ‘Stipulated Period’ includes the ‘Justified Period Extended without action under Clause 2’ , i.e. without levy of compensation . This simply means that the Stipulated Period is not just the one mentioned against Clause 5 in Schedule ‘F’, but it also includes extra time allowed for any deviations from the contract and the time lost due to hindrances which is granted without levy of compensation .

Clause 12 of the agreement provides as under :

“12.1 The time for completion of the work shall , in the event of any deviation resulting in additional cost over the tendered value sum being ordered , be extended , if requested by the contractor , as follows :

- In the proportion which the additional cost of altered , additional or substituted work , bears to the original tendered value , plus

- 25% of time calculated in (i) above or such further additional time as may be considered necessary by the Engineer-in-Charge .”

From the above provision it may be noted that it is obligatory on the part of the Engineer-in-Charge to grant additional time for execution of additional work , if so requested by the contractor . The extension granted for execution of additional work is different from the extension granted under Clause 5 due to various hindrances . Clause 12.1 does not allow any discretion to the Engineer-in-Charge and it even gives a formula for determining the extra time on account of deviations resulting in additional cost over the tendered value of the work.

The extra time on account of extra work done by the contractor, without any consideration of the hindrances is worked out as under in the sample contract work :

Extra time permitted for execution of extra work , without including escalation

= 12 x ( 5,00,00,000/20,00,00,000) x 1.25

= 3.75 months

Extra time permitted , if Clause 10 CC becomes applicable

= 12 x (6,00,00,000/20,00,00,000)x1.25

= 4.5 months

The time limit of 12 months provided for in the agreement was for the execution of work to the extent of Rs.20,00,00,000/- i.e. the tendered value of the work . This means that the scheduled completion time for this amount of work was 12 months and if the contractor executed work to this extent before the end of 12 month period he would become entitled to Bonus under the said Clause to the extent of the time so saved .

But due to increase in the quantum of work , on account of deviations/additions ordered by the E-in-C , the contractor had to execute the work to the extent of Rs.25,00,00,000/-

(without inclusion of escalation under Clause 10(CC) which changes the scheduled completion time from 12 months to 15.75 months (12 + 3.75 months) (under Clause 12.1(i) .

With the inclusion of escalation (10CC) amount of Rs.1,00,00,000/- the quantum of work executed increases to Rs.26,00,00,000/- the scheduled completion time changes further from 15.75 months to 16.5 months (12 + 4.5 months) .

In addition , a period of 5 months has been justified only on account of hindrances and delays on the part of the Department on which the contractor had no control . This further changes the scheduled completion time to 21.5 months (16.5 + 5 months) against the original scheduled completion time of 12 months .

Against this scheduled completion time of 21.5 months the contractor completed the work in 18 months , thus saving a time of 3.5 months to the Department . The contractor , therefore , becomes entitled to an amount of Bonus equal to 3.5% of agreement amount i.e. Rs.70,00,000/- in terms of Clause 2 A of the agreement .

In case the Bonus has not been paid in this case (which most certainly will be the case

, as the Departmental Officers can hardly be expected to see things in an objective manner , due to various restraitns and fears) the contractor can claim simple interest also @ 10% P.A. from the date the payment of his final bill became due . This is so because Clause 10B(IV) of GCC provides such a rate of interest for payment of Mobilisation Advance and Plant & Machinery Advance to the contractor , due to which this rate of interest becomes an agreed rate of interest between the Department and the contractor.

2.Payment of Escalation :

The period of completion i.e. scheduled completion time of 12 months has been provided on the very assumption that all designs , drawings , written directions etc. required for completion of the work within that period shall be available and be provided to the contractor on the Stipulated Date of Start (SDS) itself in accordance with Clause 11 of GCC .

There is a provision in Clauses 5 & 12.1 for extension of this scheduled completion time in the likely event of occurrence of any delays/hindrances etc. , which are beyond the control of the contractor , and deviations/additions ordered in the work .

Normally Escalation under Clause 10CC is not payable if the scheduled period of completion is less than or equal to the time specified in Schedule ‘F’ . Let us be clear about this . The Scheduled Completion Time is the period mentioned against Clause 5 in Schedule ‘F’ . The time mentioned against Clause 10 CC in Schedule ‘F’ is only for the purpose of application or non-application of Escalation under Clause 10 CC .

It is to be noted that Clause 10 CC mentions that “ —- such compensation for escalation in prices and wages shall be available only for the work done during the Stipulated Period of the contract including the justified period extended under the provisions of Clause 5 of the contract without any action under Clause 2 ”.

This means that the ‘Stipulated Period’ includes the ‘Justified Period Extended without action under Clause 2’ , i.e. without levy of compensation .

Where Clause 10 CC is not applicable Escalation is to be paid under Clauses 10 C &10 CA.

However , in the present case the work had to be continued beyond the Stipulated Period of 12 months and was actually completed in a period of 18 months , even though the scheduled completion time , in accordance with Clauses 5 & 12.1 , works out to 21.5 months, as explained earlier .

Even though the scheduled completion time increased from 12 months to 21.5months, as explained earlier , the work was actually completed in 18 months .

The Contractor can , therefore , Claim that he should be paid escalation under Clause 10 CC of the agreement for the whole period of execution of the work as extension of time till the actual completion of the work has been granted without action under Clause 2 of the agreement . The amount due to him on this account works out to say Rs. ‘X’ ( Details will have to be furnished by the Contractor , based on the formulae given under the Clause) .

The E-in-C can always be expected to refuse to examine the Claim under the mistaken notion that the said Clause of the agreement is not applicable . This is how the Department normally views such a Claim under such conditions .

Since Escalation becomes payable under Clause 10 CC the Clauses 10 C & 10 CA will

, consequently , become inoperative .

In addition to the foregoing , attention is also invited to Section 73 of the ‘Indian Contract Act ,1872’ which reads as under :

“73. Compensation for loss or damage caused by breach of contract – When a contract has been broken , the party who suffers by such breach is entitled to receive , from the party who has broken the contract , compensation for any loss or damage caused to him thereby

, which naturally arose in the usual course of things from such breach , or which the parties knew , when they made the contract , to be likely to result from the breach of it .

Such compensation is not to be given for any indirect loss or damage sustained by reason of the breach .”

The contract was broken by the Department on account of various hindrances , wholly attributable to it . Also the terms of contract got totally changed when , besides the period of hindrances , the extra period required for executing extra work changed the Scheduled Period of Completion from 12 months to 21.5 months , thus making Clauses 2 and 10 CC applicable

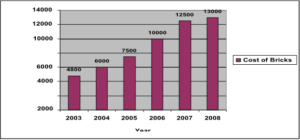

, which were not applicable at the time of entering into agreement . Due to prolongation of the period of construction the Contractor was forced to incur extra expenditure on increased rates/cost of materials and labour etc. This can be proved by the change in the Wholesale Price Indices (WPIs) from those prevailing at the time of the last stipulated date of receipt of tender . The WPI is published regularly by the Ministry of Commerce & Industry , Govt. of India .

Thus , with the Clause 10 CC becoming aplicable , due to the changed circumstances of the matter , the Contractor can claim payment of Escalation .

Alternatively , he can claim compensation under Section 73 of the ‘Indian Contract Act , 1872’ for losses suffered by him on account of increase in prices/costs of materials and labour etc. due to delayed completion of the work .

Zakir Hussain ,